One month since we left the shores of the Bodensee and our friends at AERO 2025 in Friedrichshafen, and it feels like a good time for a status update. Certainly enough has transpired to keep us all entertained in the aviation world, to say the least.

First, congrats go out to the AERO gang for a phenomenal success and a show that marked tremendous growth for the organization. With more than 760 exhibitors and 32,000+ attendees, the event clearly resonated with the moment.

You have to be prepared to meet opportunity, and Tobias Bretzel and team took advantage of the opening left by EBACE’s recasting. AERO had made significant forays into serving the business aviation world more directly in recent years, with exhibitors such as Gulfstream attending last year with an aircraft, and more significant displays from Textron Aviation, Pilatus, and charter operators.

Those continued this year with Bombardier, Dassault Aviation, and Gulfstream providing an outdoor exhibit, along with Platoon Aviation’s sponsorship of what I’m calling the Big BizAv Tent (it went by the official name “Business Aviation Dome”). The venue provided space for various small exhibits, along with a café of sorts and a coffee/wine bar, along with a stage for forums, several of which I attended. This was perhaps the only off note; those hosted in the afternoon in particular suffered from too much sunlight in the wrong place, and strange cube-like seats that weren’t well suited for attendees needing to balance a notebook or device. Minor details, though.

The topics covered throughout the show were on target, however, including the next in the series on Single-engine Turboprop Operations (SETOps), and industry and technology updates. I admit I have been so distracted following the ongoing tariffs saga that I have yet to complete my analysis of the current state of SETOps, which honestly feels like it’s in a bit of a holding pattern while everyone figures out where the industry will land, tax- and delivery-wise!

Which brings me to the current state of affairs. Time to look back at the questions I posed in February, on the following topics:

- Tariffs by the U.S. and retaliatory answers from Canada, Mexico, China

- The charge to slash U.S. government regulations and only replace them at a 10:1 ratio

- Egregious use tax implementation in Europe, targeting business aviation

- Deeply cutting personnel reductions at key agencies, including FAA, DoT, and Department of Commerce

- Privatization of the National Airspace System in the U.S.

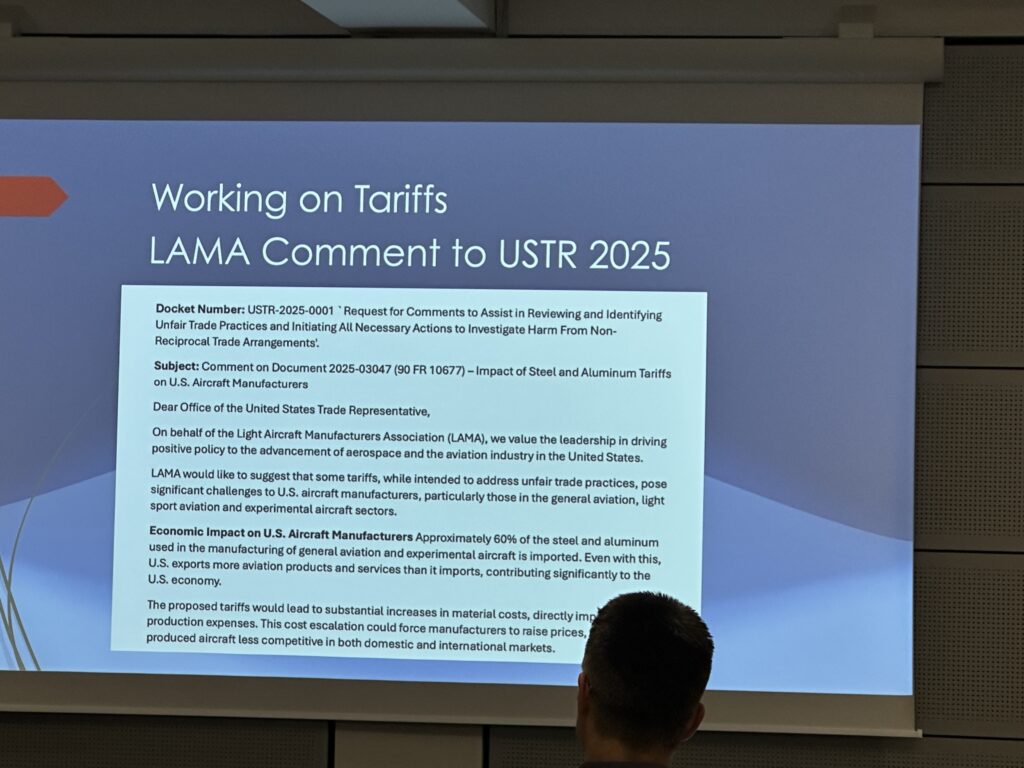

On tariffs. Well, the good news, I suppose, is that the U.S. has apparently walked back from the outrageously steep 145% tariffs applied to many goods from China, down to 30%. And there’s a 90-day pause on many of the remainder, including goods from the EU, Mexico, and Canada. However, the chaotic nature of their application and the resulting retaliation means companies are still having a tough time planning for the future. A 90-day crystal ball just isn’t enough. I think of one good friend who has a publishing company, and he’s in limbo trying to figure out where to have books printed these days. The last container with a pallet of their merchandise on board left China back in mid April. Knowing what tariffs will apply remains a guessing game.

On regulations. We’ve seen more cuts in terms of personnel across government departments than the regs themselves, including at the FAA, and that pain lingers. At the same time, specific regulatory initiatives such as MOSAIC appear to be moving forward, with a final rule to be released late this summer, according to an update from the Light Aircraft Manufacturers Association at AERO.

On EU taxes. France went ahead with its tax on commercial flights, which includes business aviation, to the tune of “420 euros for a passenger on a business jet flying to a destination within the EU or European Economic Area to 2,100 euros per passenger flying to a destination more than 5,500 km away,” according to NBAA. Passenger fees for turboprop aircraft are roughly half the jet rates, which makes the SETOps mission all the more critical for operators to leverage if the capacity fits.

On personnel. I know folks personally who have seen their federal jobs cut, in what appears to be an arbitrary fashion. At the same time, the news this week has featured the lack of necessary staffing in operations including air traffic control, with Newark headlining the worst of the news.

On privatization. So, would a private entity do a better job addressing both the problems of National Airspace System modernization and personnel reductions and shortfalls? A broad coalition of aviation associations endorsed the recent plan announced by Secretary of Transportation Sean Duffy. Nowhere in the points outlined by Duffy over the course of the 3 to 4 year effort does the plan *appear* to include the broad stroke of privatization. We know we need an overhaul of the system…and if there’s political will to get it accomplished, I’m all for that. But this administration’s overarching theme has been to privatize across the U.S. government, so I cannot believe that won’t be the case here.

And it’s frankly too soon to tell, especially given the past 100+ days of 2025.